SIA ASSET STANDARD'T is a Latvian company that uses the INVEX FONDI trademarks and provides its clients, as an intermediary, international export factoring services throughout the EU territory, as well as in Asia and the Americas:

- with financing up to 90%

- for export to 90 countries worldwide

- no collateral

- with 100% buyer risk coverage

The main provisions of the factoring services:

- The buyer's limit is determined by the buyer's paying capacity

- The factoring limit is determined by the client's ability to deliver goods and services in a certain amount

- The buyer's payment period is usually up to 90 days, but for certain groups of goods, the period may be longer

- The financing amount of 70%-90% is determined depending on specifics of goods or services, the remaining amount is received by the client after payment by the buyer

- The factoring agreement is usually concluded for 1 year

- Financing is provided when the client fulfills the terms of delivery of goods or services and submits supporting documents to SIA ASSET STANDARD'T

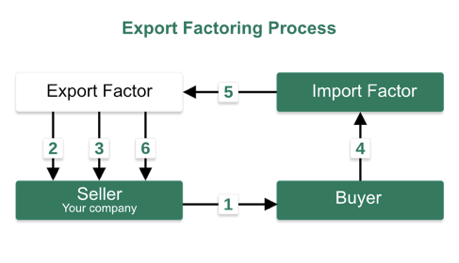

- The buyer's debt is transferred to the Export Factor, who, respectively, transfers it to a partner in the buyer’s country, who can accept the buyer's risk (Import Factor)

On receipt of application form from your company, SIA ASSET STANDARD'T submits documents and information received, to a Partner - Export Factor, whose duty is to contact a specific buyer in order to determine the limit of factoring. If the buyer's limit is confirmed, then:

- Your company signs a purchase agreement with the buyer

- Your company signs a factoring agreement with the Export Factor

- Your company informs the buyer about factoring using a letter

Further:

- Your company delivers the goods to the buyer

- Your company, through the Export Factor (through mediation with SIA ASSET STANDARD'T), transfers the rights of claim to the buyer of the Import Factor, submitting SIA ASSET STANDARD'T the documents confirming the sale transaction - contracts, invoices, and delivery documents

- Export Factor transfers the previously agreed cost of financing to your company, which is up to 90% of the total cost of the goods, taking into account the cost of factoring services

- Import Factor collects payments to invoices in accordance with the payment terms

- Import Factor transfers the collected amount to Export Factor

- Export Factor transfers the difference between the payment amount received and the previously agreed factoring financing advance.

Factoring application.