Crediting of international market operations

INVEX FONDI ® offers bank financing for transactions with various product groups, which have a wide target market and forecast of liquidity.

Bank finances

- purchase of goods for export;

- goods in stock;

- goods during transportation;

- deferred payment for the goods supplied.

Conditions for financing each specific project are individual. Allocation of funding depends on the specifics of the project. We offer solutions to reduce currency risks.

Basic conditions for financing of trade:

- The recommended amount of credit: EUR 500 000;

- Loan period 3 - 12 months;

- Interest rate: 7% * per annum;

- Funding amount: 50 - 90% * of the commercial value.

*depending on the risk assessment

Priority products and product groups:

- metals;

- cotton;

- sugar;

- petro chemistry;

- wheat and other grains;

- mineral fertilizers;

- coal;

- deep-frozen foods (meat, fish, poultry).

-

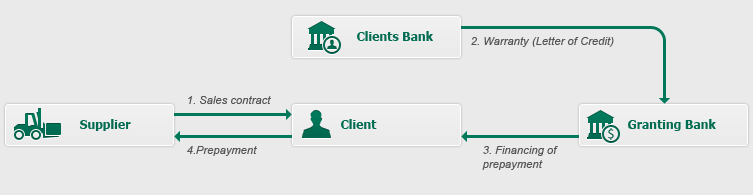

Financing the goods intended for export

Client enters into a contract for acquisition of goods. If the contract provides for an advanced payment to the supplier, then the granting bank provides prepayment after receiving of Bank guarantee for repayment of prepayment after contract our reception for letter of credit from coherent Bank.

-

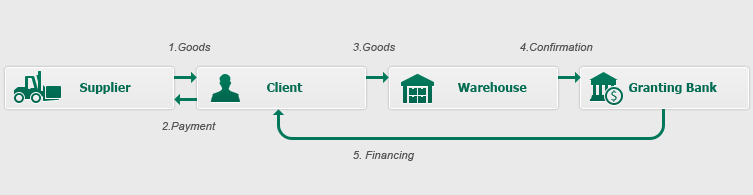

Financing of goods in warehouse

Client makes a purchase of goods and by an agreement with the Bank places them in a warehouse. Bank provides funding after receiving of conformation that the purchased goods are placed in the warehouse. Warehouse provides storage of goods for client, thus ensuring interests of Bank.

-

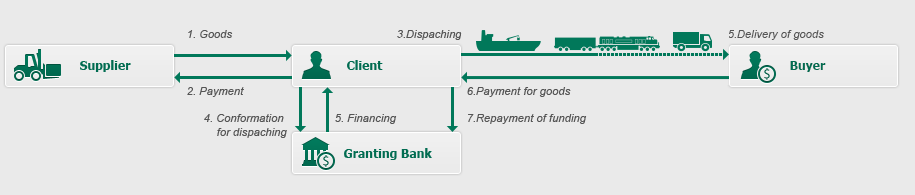

Financing of goods during transportation

Client makes acquisition of goods and ensures their dispatch. Bank ensures funding for client after receiving transport order, indicating shipment of goods (bills of lading, consignment notes).

Granted funds must be repaid to the Bank after delivery of goods or before receiving the goods from warehouse if the goods are held in a customs warehouse with whom there was a previous agreement about it. -

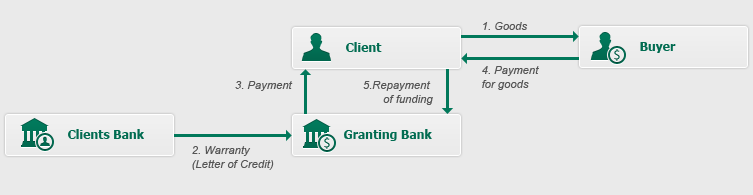

Financing of deferred payment

Client makes delivery of goods in agreement of contract that stipulates a deferred payment. Bank ensures funds for Client for the delivered goods for the time of deferred payment.

Buyer's payment obligations are confirmed by guarantee or letter of credit from a coherent bank, as well as the risk of default by the purchaser could be insured by specialized insurer.

Financing of deferred payment depends on each individual case and could be executed as factoring or line of credit.

The main requirements for the client (the borrower) and the parameters of the transaction to be financed:

- Clients experience in trading of goods at least 1 year;

- The client is financially stable;

- Clients participation of financing the goods – 10 – 50%;

- The goods are liquid and are valid for at least 12 months;

- Organized control of the purchased goods from forwarders, monitors and warehouses.